Imagine owning a rental property without having to prove your personal income, jump through endless hoops, or drain your savings. That’s exactly the kind of opportunity a DSCR (Debt Service Coverage Ratio) loan can offer. For many aspiring investors, this isn’t just another mortgage product — it’s a wealth-building gateway.

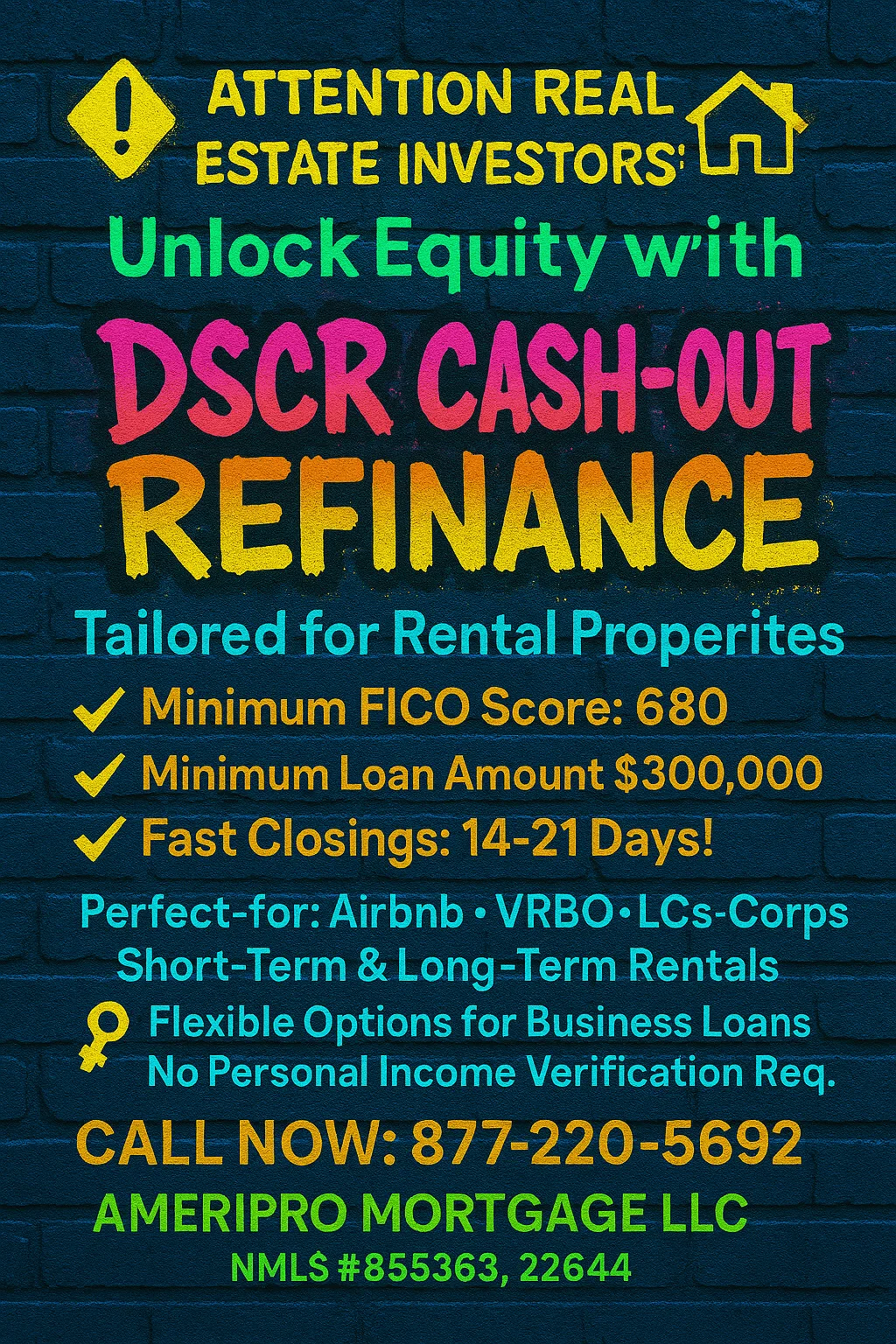

A DSCR loan is a type of real estate financing based on the property’s income potential—not your W-2, pay stubs, or tax returns. Lenders look at whether the rental income can cover the loan payments, meaning you can qualify based on the strength of the investment, not your personal financials.

💸 Access to Real Estate Without Traditional Barriers

You don’t need to be a high-income earner or have perfect tax records. If the property cash flows, you could qualify.

🏡 Grow Your Passive Income

One rental could pay your car note. A few could replace your job. With a scalable strategy, DSCR loans let you stack properties and build passive income streams—one closing at a time.

📈 Build Long-Term Wealth

Real estate is one of the most powerful vehicles for generational wealth. A rental bought today could appreciate in value, generate cash flow, and provide tax advantages for years to come.

⏱ Quick Closings = More Opportunities

DSCR loans often close in 2–3 weeks, meaning you can move fast in competitive markets and lock down great deals before other buyers.

🛠 Business Mindset, Real Results

With DSCR financing, you're treated like a business—not just a borrower. That shift in perspective alone can launch your journey from employee to entrepreneur.

Ready to turn rental income into real freedom?

With the right property and a DSCR loan, the path to financial independence could be closer than you think.

💼 Let Ameripro Mortgage LLC (NMLS# 855363) help you take the first step.

📲 Call 877-220-5692 or visit www.ameripromortgage.com to get started today!

Lending in Idaho and California nmls#22644,855363